How I became the hero of the Chief Marketing Officer

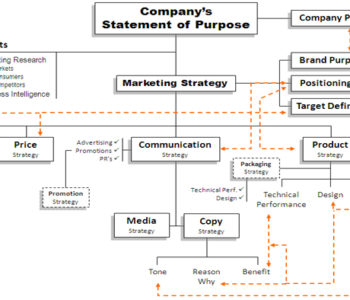

A marketing officer in charge of 10 brands and $200 Mio. worth of revenues asked how they could solve their data quality issue and still enjoy the agility and convenience of DIY surveys. The answer was easy:

Let’s build your own panel of survey respondents.

I offered the example of a European company maintaining a pool of some 2,000 housewives who judge their new products. The company delivers the test products to selected persons, together with a short questionnaire and instructions.

The results are impressive. They run three times more tests than when they worked with expensive agencies, the cost per interview has dropped significantly, and their market share keeps growing. To the great satisfaction of the CMO.

The advantage of maintaining your own panel of survey respondents is in the believability of the information you gather:

- There is no risk that you are interviewing a robot or even receiving fake data.

- Faith in your data-driven decisions increases, and you have the confidence to test more new ideas and activities.

- The marketing team gets energized and more action happens.

In times of lean budgets and fake data, having your own panel of respondents is an appealing idea, but it doesn’t come without a price.

How to create and maintain a panel of survey respondents

Marketers ask three typical questions when considering building their own pool of survey respondents:

- Who should be recruited?

- How many persons should be recruited?

- How to manage the pool of respondents?

1. Who should be recruited?

It could be your clients, or the product category users at large.

Creating a pool from your clients is often the easiest way. This could be a good solution if you are investigating the taste or functionality of your new products, satisfaction levels, recall from the last visit of your reps, and the like.

But if you also want to make estimates of market size, market share of competitors, propensity to buy, or the memorability of an ad (yours or a competitor’s), you should not limit your recruitment to your own client base. Asking only your clients may return misleading information.

In this case, I recommend enrolling product category users at large, buyers and users of the product category you intend to investigate, whether your clients or not. This way, the information your panel delivers can be projected to the overall market level.

A competent survey consultant can make you aware of risks and opportunities linked to the use of one or another respondent type.

Another instance is Points of Sale (POS). A selected group of POS can supply useful information from their scanner data. It can be used to estimate size and tendency of markets, prices by reference and category, competitors by segment, rotating volumes, and more. Companies like Nielsen AC and IQVIA sell panel data of this kind, for a high price.

Be it private persons or POS, creating a solid panel of respondents is doable and convenient.

2. How many should be recruited?

The answer depends on the level of accuracy your decisions require.

There are cases when you can live with a 7.5% error level, which soars when reading split data, like Male/Female, Very satisfied/Satisfied/ Neither – Nor, and so on.

In other cases, you want more accuracy and set the error level to 3% or even 2%, which implies a much larger sample size. In general, a sample carrying a 5% overall error level requires 384 respondents. 1,066 respondents are required for an error of 3%, and 2,395 for an error of 2%.

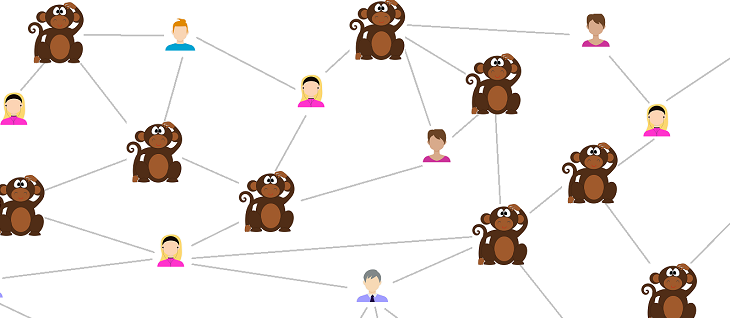

Your total pool of persons to draw from should be considerably larger than the number of interviews you want to collect – in general I would suggest 4 to 6 times larger. So, for a sample of 384, a full list of some 2,000 persons would be adequate. That would be a good start.

Keep in mind that a panel pool is a living entity. It will need adjustment over time, as members drop off, or you want to make the pool larger or smaller.

3. How to manage the pool of respondents?

There is a lot of work at the start, and then it slows down with time.

To manage a pool of 6,000 persons, my experience suggests that between 1 and 1.5 FTE (Full Time Equivalent employees) can do the job. One FTE maintains the relationship with the respondents (typically by email), and a database wizard keeps the list clean and ready to query.

When the need arises, a given number of persons are invited to take your survey. From those who agree to participate you select the required number of respondents for your sample, and invite them to take the survey.

Although straightforward, the process should be overseen by a competent eye in order to make sure, from a statistical point of view, that the data to gather measures what you intend to measure. Not a big deal for an expert survey consultant, yet a vital issue for every marketing research project.

Advantages of your own panel of survey respondents

We have already mentioned the convenience as opposed to buying surveys from specialized agencies; there are also the speed, flexibility, and the trust implicit in running a survey using your own panel of respondents.

There is more.

Companies working with their own panel deepen their knowledge in the field of social research.

It can help decision-makers to understand the information better, and may prove useful in a number of other company areas.

Moreover, an own panel of survey respondents eliminates some of the dependency on third parties, and that feeling of independence is rewarding in itself.

Closing

If you are serious about data-driven decisions, consider building your own group of survey respondents.

It’s about real answers you can trust.

And, wondering who can help you create your own panel of survey respondents?

This is an easy catch: drop me a line!

[1] In 2022 the global market research market was some $80+ Bn. and grew +3.4%. Annually, P&G alone invests 0.5% of their revenues, or some $400 Mio., in data and information. Specialized marketing research agencies must be doing something right to have continued to grow for decades.